UAE COMPLIANCE

UAE & Global Regulatory Alignment

Tailored specifically to meet local DNFBP requirements and UAE AML regulations.

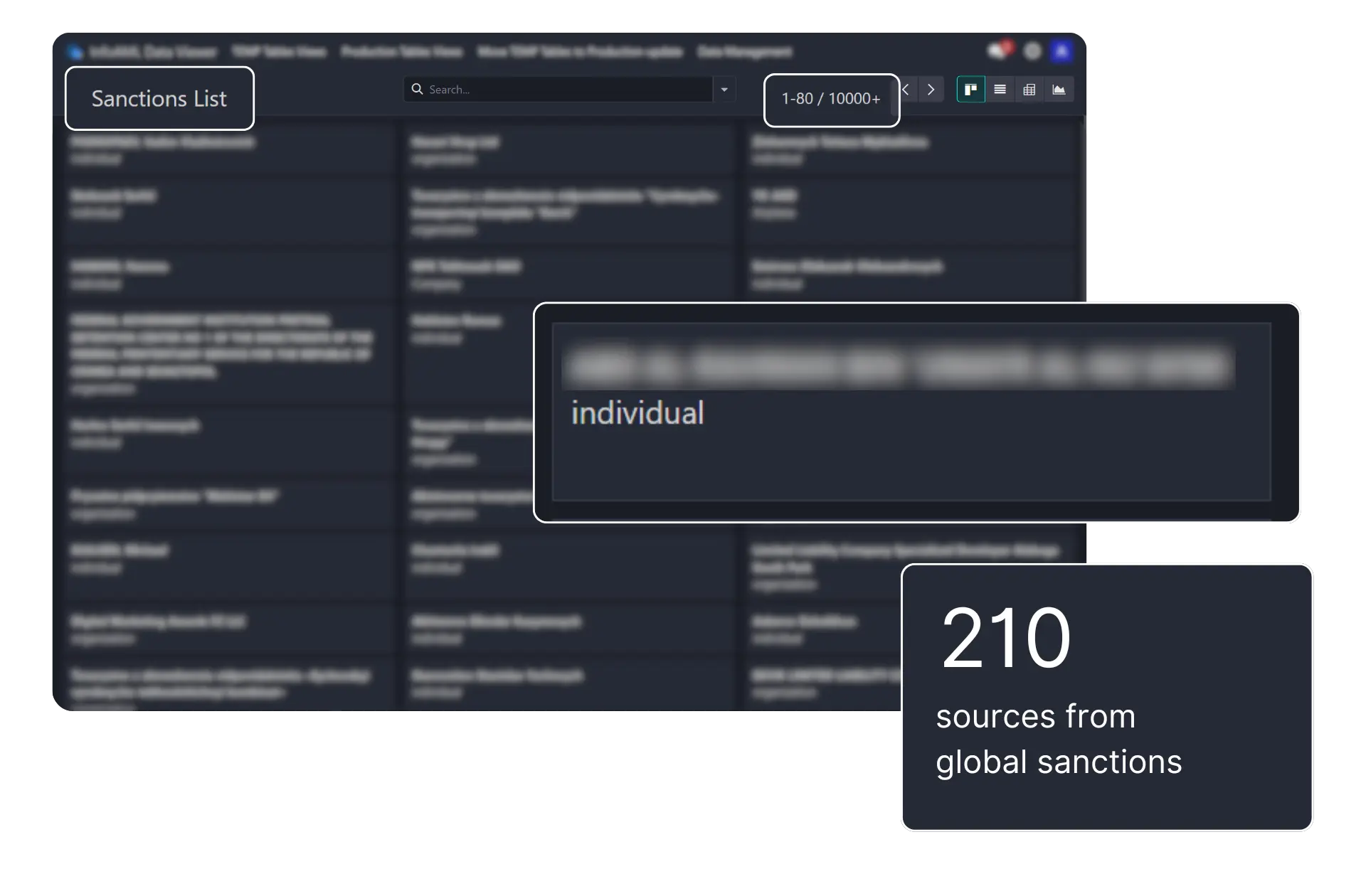

Utilizes the UN sanctions list along with aggregated open-source data, covering sanctions information from over 210 sources for comprehensive screening.

Our system continuously refreshes sanctions data by regularly pulling updates from trusted regulatory sources and open databases, ensuring your screening criteria always reflect the latest international and local compliance standards.

Tailored specifically to meet local DNFBP requirements and UAE AML regulations.

Utilizes the UN sanctions list along with aggregated open-source data, covering sanctions information from over 210 sources for comprehensive screening.

Our system continuously refreshes sanctions data by regularly pulling updates from trusted regulatory sources and open databases, ensuring your screening criteria always reflect the latest international and local compliance standards.

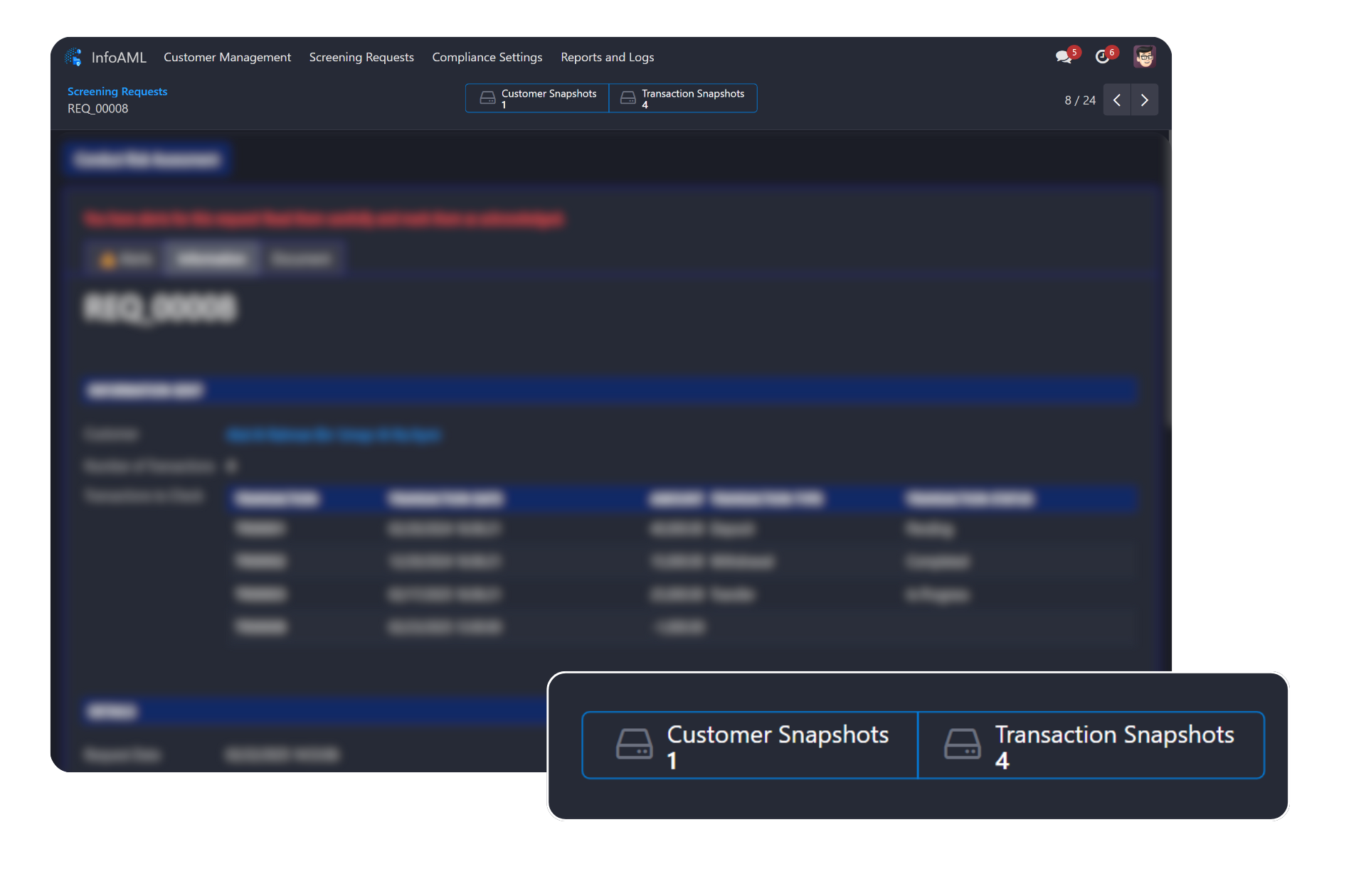

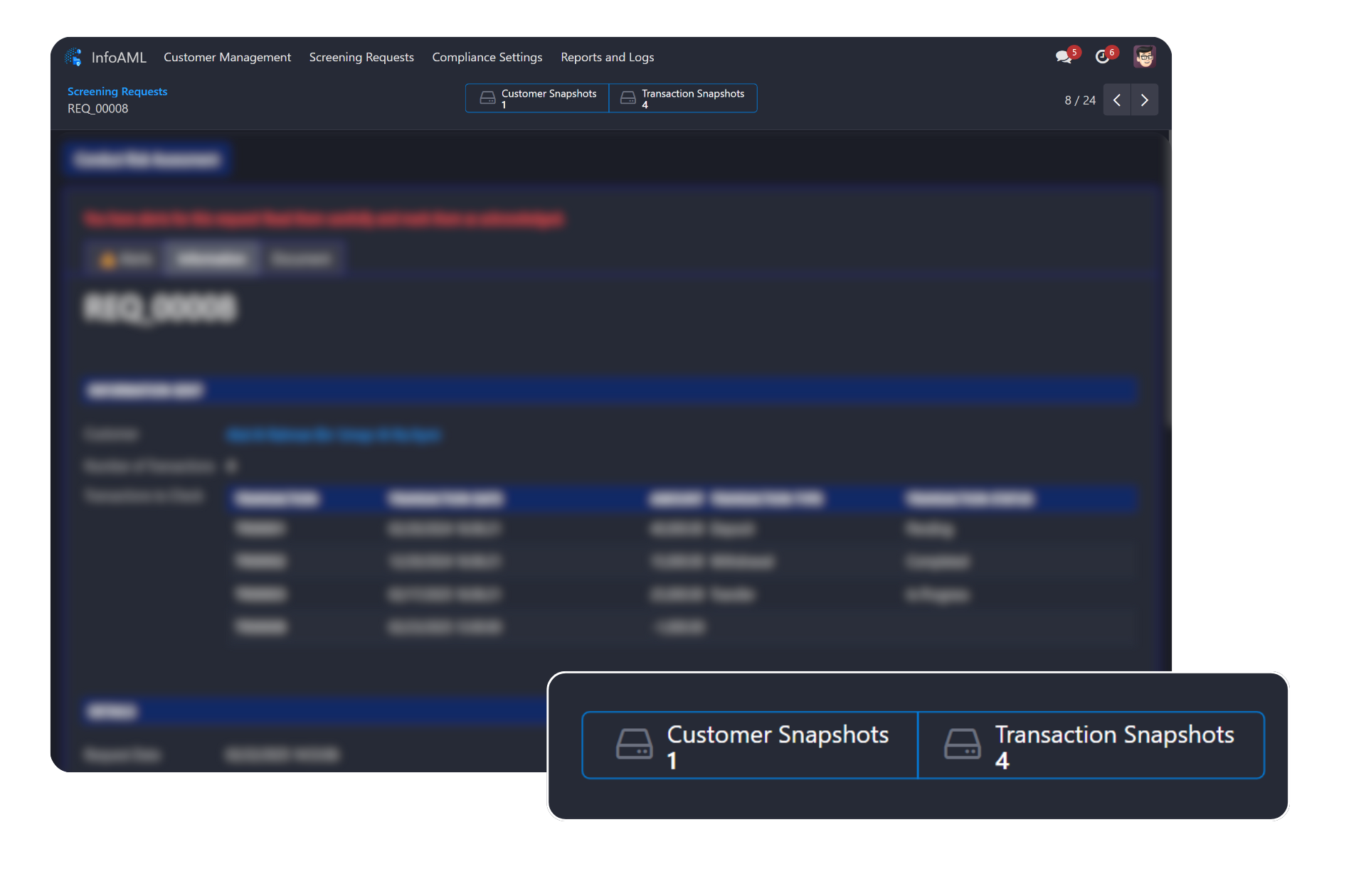

SCREENING PROCESSES

Comprehensive AML Screening

Provides immediate screening of customer and transaction data against local (UAE) and international sanctions lists.

Identify Politically Exposed Persons (PEPs) through specialized watchlists and automatically flag them for enhanced due diligence.

Evaluates both financial transactions and basic identity data (KYC) for AML risks.

Processes up to five customers or transactions at once, streamlining routine checks without handling them individually.

Provides immediate screening of customer and transaction data against local (UAE) and international sanctions lists.

Identify Politically Exposed Persons (PEPs) through specialized watchlists and automatically flag them for enhanced due diligence.

Evaluates both financial transactions and basic identity data (KYC) for AML risks.

Processes up to five customers or transactions at once, streamlining routine checks without handling them individually.

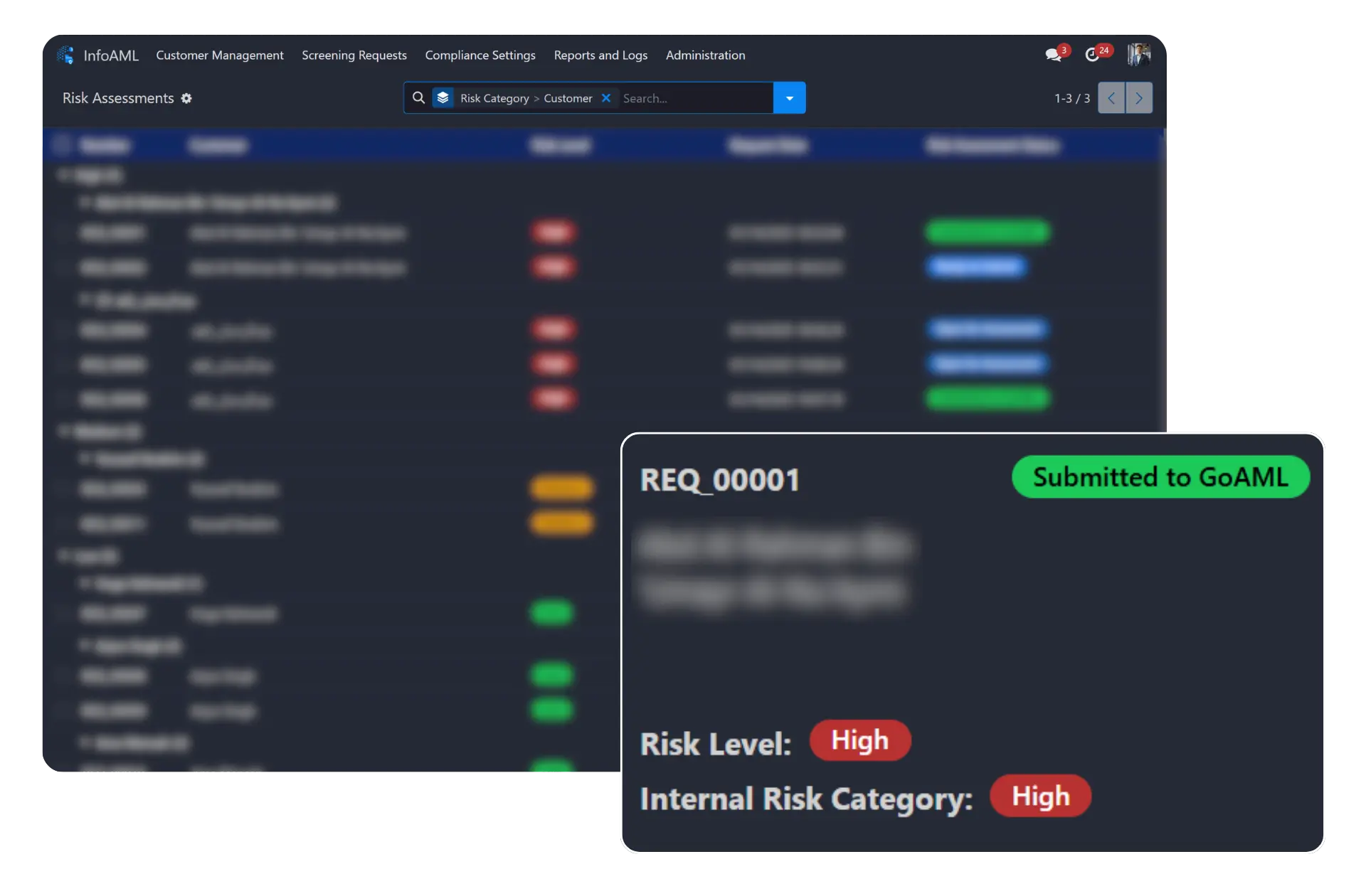

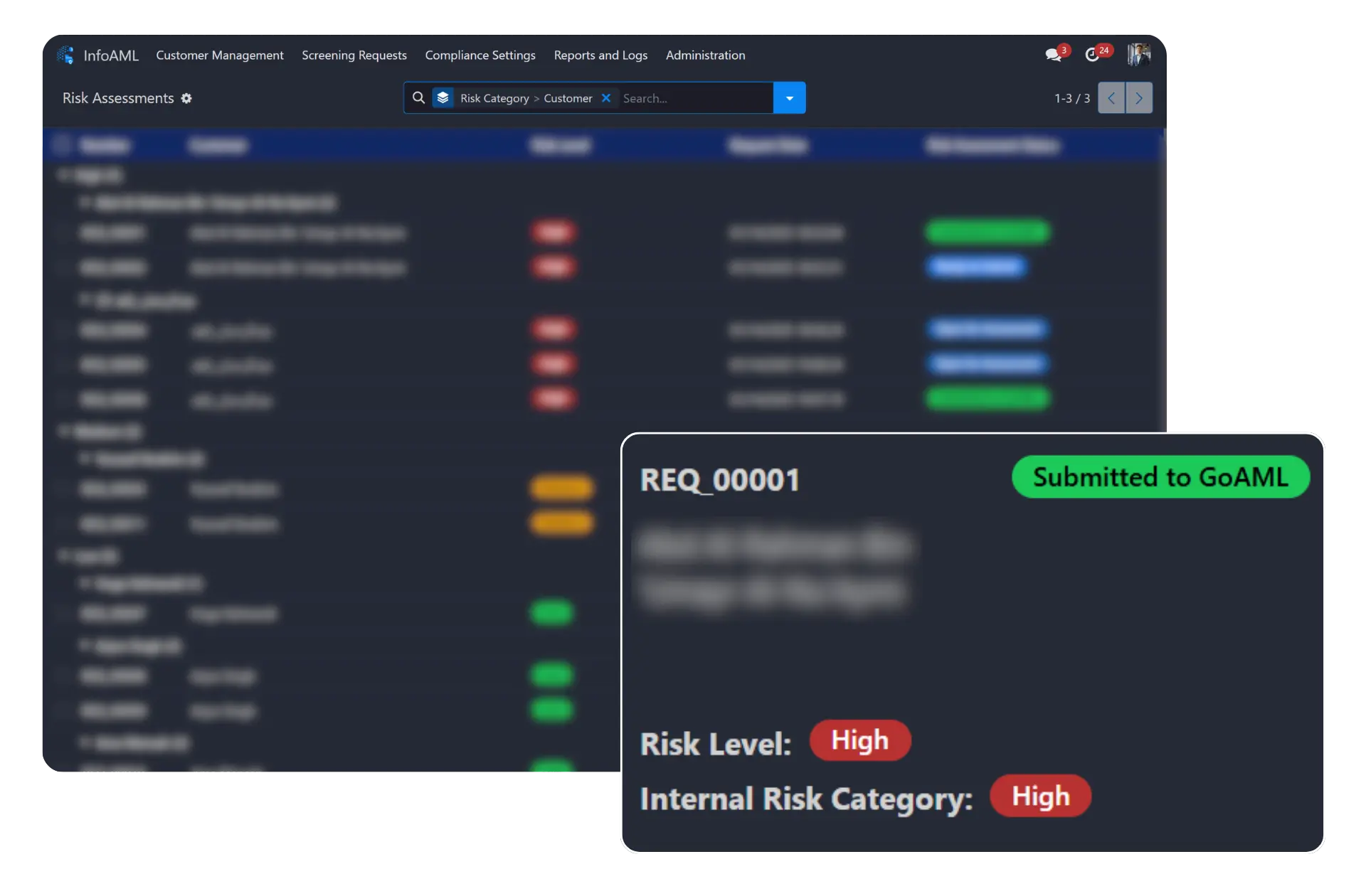

RISK DETECTION

Risk Management & Alerts

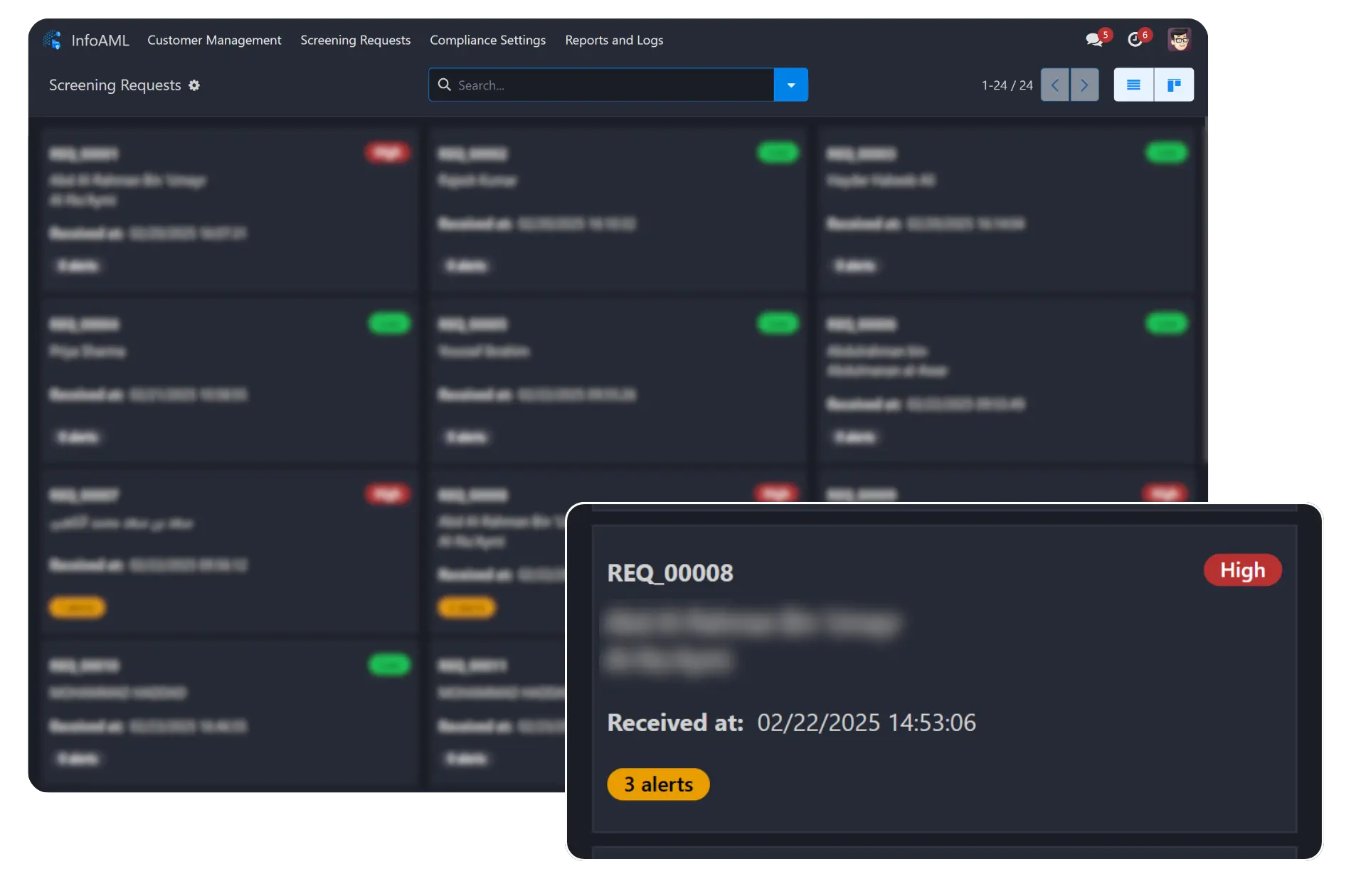

Dynamically calculates a risk level (Low, Medium, High) for customers and transactions.

Displays alerts directly in the dashboard whenever a suspicious match is found, ensuring the accountable staff member must acknowledge each alert.

The system applies realistic, server-level risk thresholds by default, while allowing clients to define their own internal risk categories for reporting. The core threshold remains managed to ensure consistent compliance.

Dynamically calculates a risk level (Low, Medium, High) for customers and transactions.

Displays alerts directly in the dashboard whenever a suspicious match is found, ensuring the accountable staff member must acknowledge each alert.

The system applies realistic, server-level risk thresholds by default, while allowing clients to define their own internal risk categories for reporting. The core threshold remains managed to ensure consistent compliance.

AUDIT LOGS

Reporting & Audit Trails

Export screening outcomes, transaction risk scores, and matched records for management review or regulator submissions.

Tracks every AML check, user action, and document verification event to satisfy UAE regulatory audits.

Generate official SAR/STR reports in PDF or HTML, ensuring easy sharing and submission to regulators.

Allows direct submission of suspicious activity or transaction reports (SAR/STR) to goAML, streamlining your regulatory reporting process.

Export screening outcomes, transaction risk scores, and matched records for management review or regulator submissions.

Tracks every AML check, user action, and document verification event to satisfy UAE regulatory audits.

Generate official SAR/STR reports in PDF or HTML, ensuring easy sharing and submission to regulators.

Allows direct submission of suspicious activity or transaction reports (SAR/STR) to goAML, streamlining your regulatory reporting process.

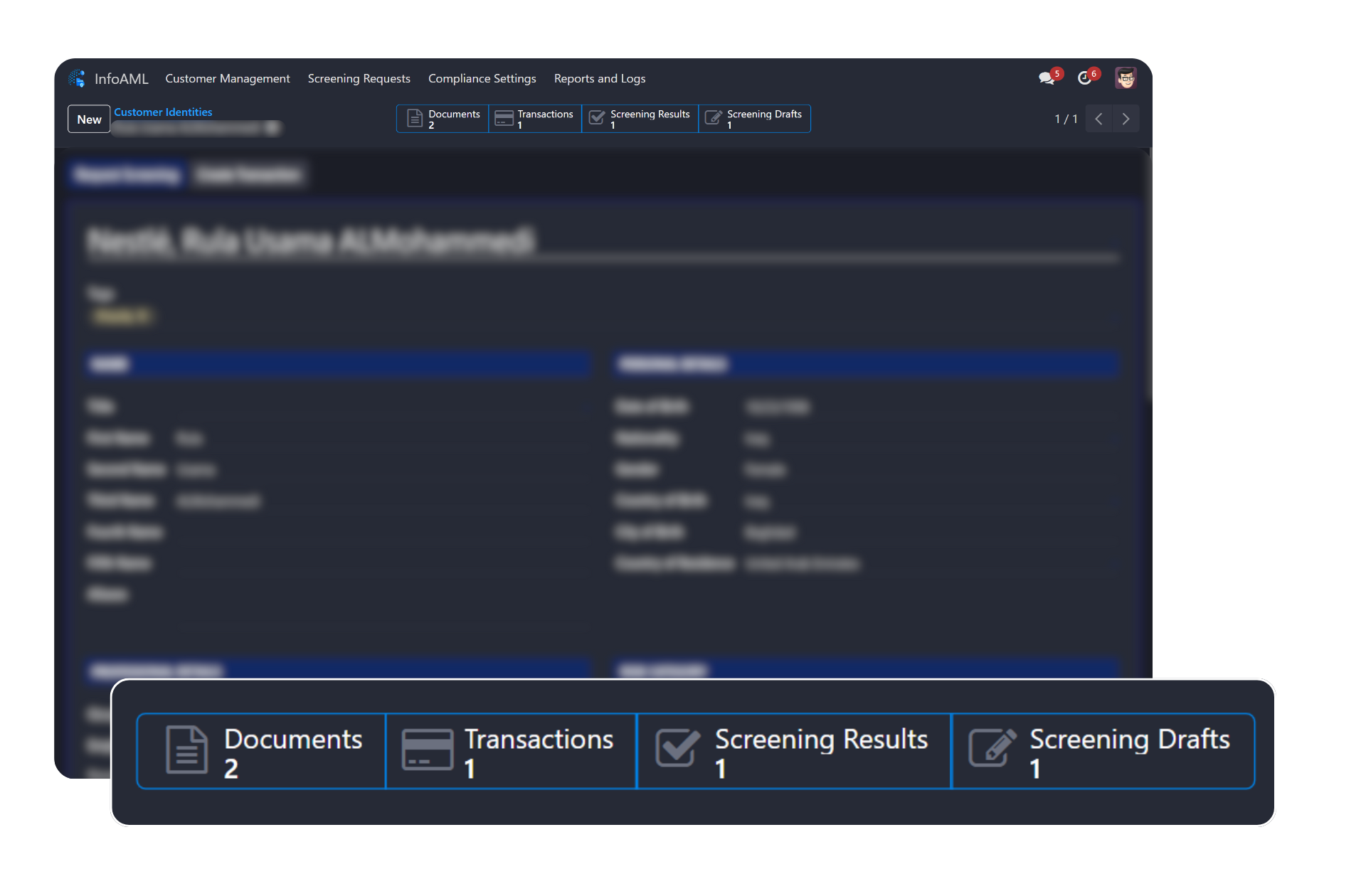

RECORD MANAGEMENT

Data & Document Handling

Links directly to the contact records provided within the AML module, automatically retrieving and updating customer details for screening.

Allows uploading of IDs (e.g., passports, UAE IDs, visas) and stores them within the AML module’s integrated document management system, linking each document to the relevant contact.

Verifies attached identity documents and tracks their status (e.g., Verified, Pending, or Expired).

Allows each customer record to include both a primary and a secondary language (commonly English and Arabic), reducing false positives when screening names in multiple scripts.

Links directly to the contact records provided within the AML module, automatically retrieving and updating customer details for screening.

Allows uploading of IDs (e.g., passports, UAE IDs, visas) and stores them within the AML module’s integrated document management system, linking each document to the relevant contact.

Verifies attached identity documents and tracks their status (e.g., Verified, Pending, or Expired).

Allows each customer record to include both a primary and a secondary language (commonly English and Arabic), reducing false positives when screening names in multiple scripts.

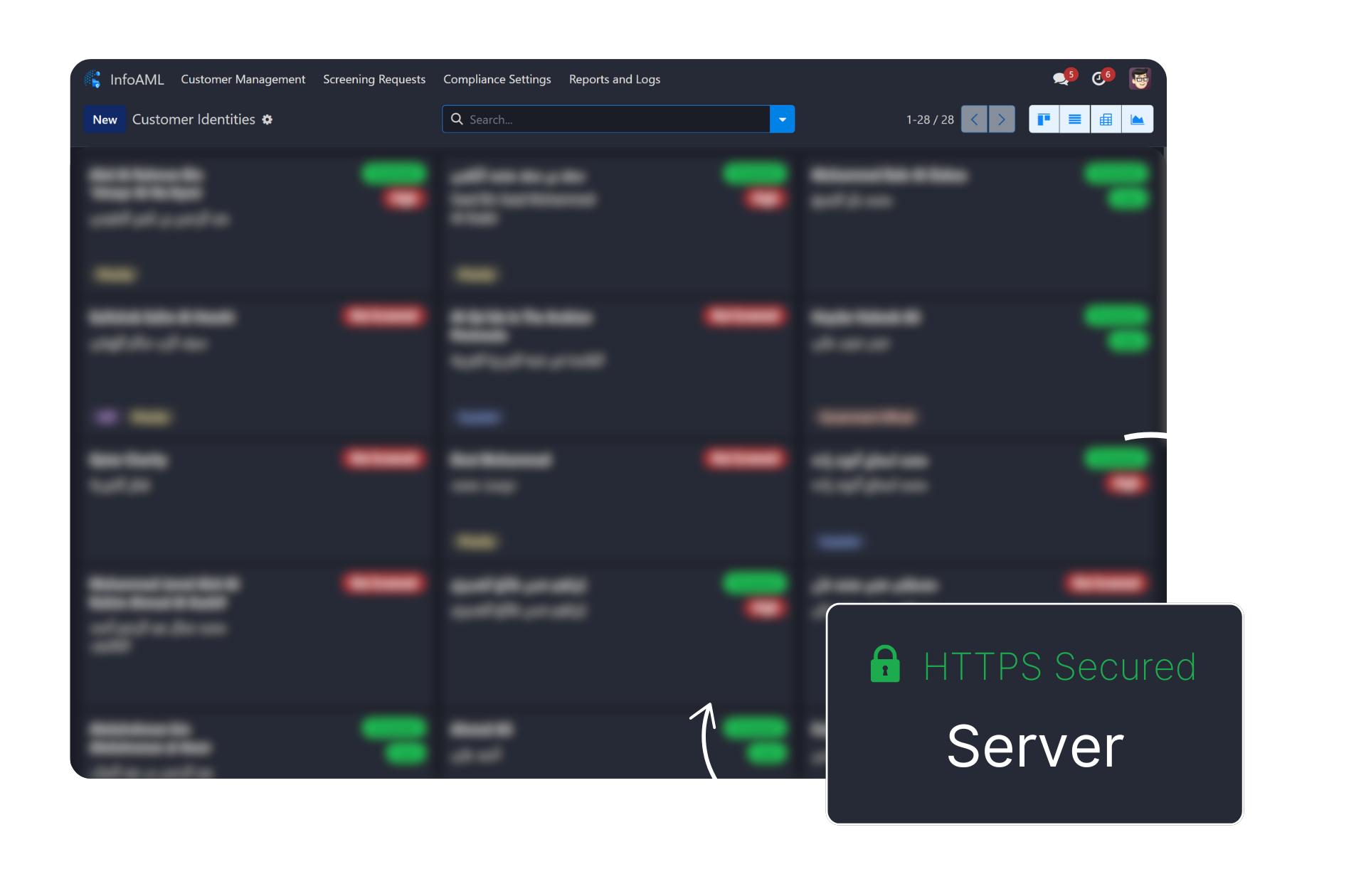

DATA SECURITY

Security & Data Privacy

All data is sent over HTTPS to a protected server environment, ensuring sensitive information remains confidential.

Restricts sensitive data to authorized personnel only, preventing unauthorized access.

No end-customer data is ever stored on our servers; all sensitive information remains securely within the client’s own environment

Essential compliance logs are maintained on our servers for up to 10 years in full accordance with UAE regulations.

All data is sent over HTTPS to a protected server environment, ensuring sensitive information remains confidential.

Restricts sensitive data to authorized personnel only, preventing unauthorized access.

No end-customer data is ever stored on our servers; all sensitive information remains securely within the client’s own environment

Essential compliance logs are maintained on our servers for up to 10 years in full accordance with UAE regulations.

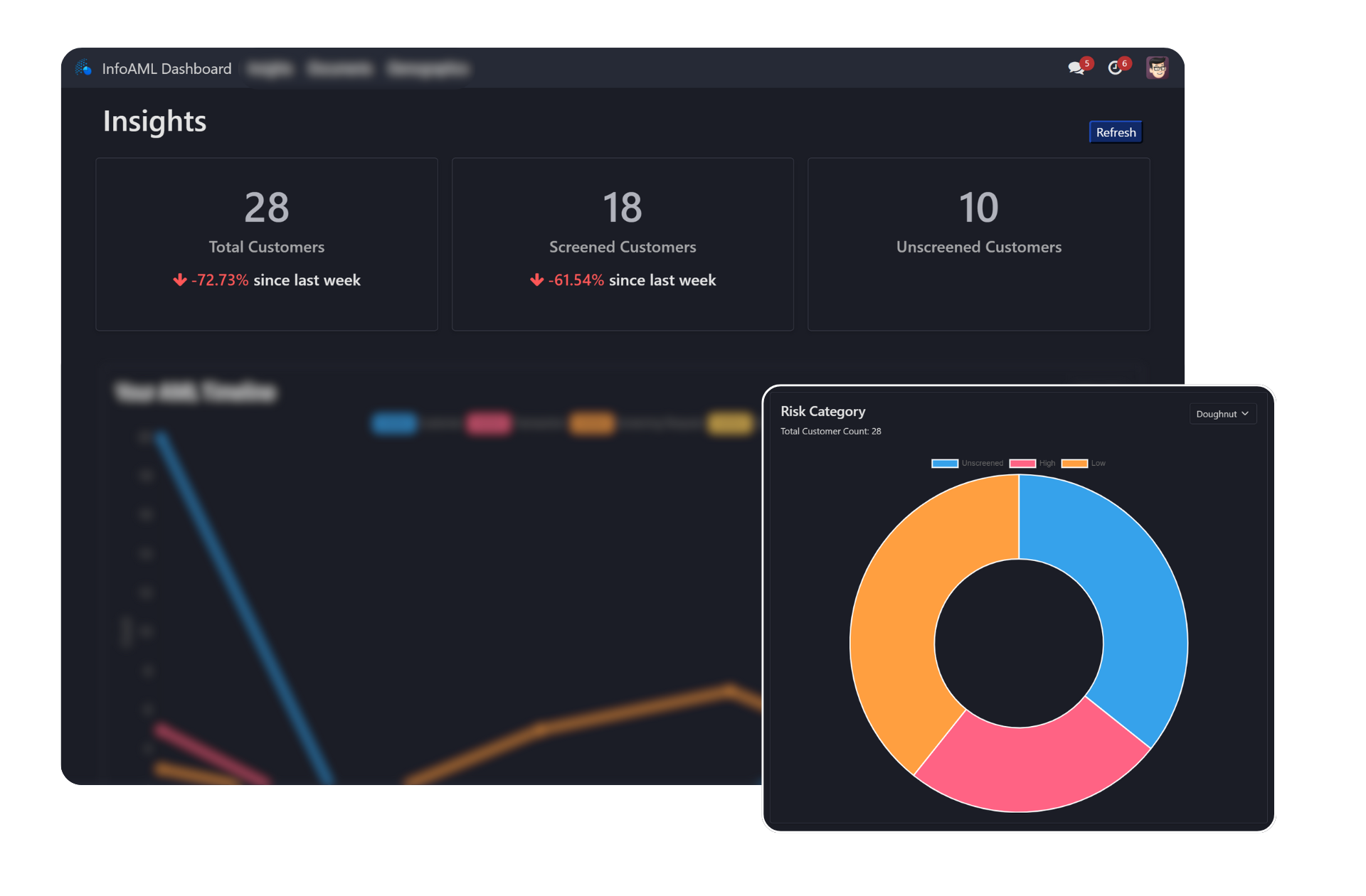

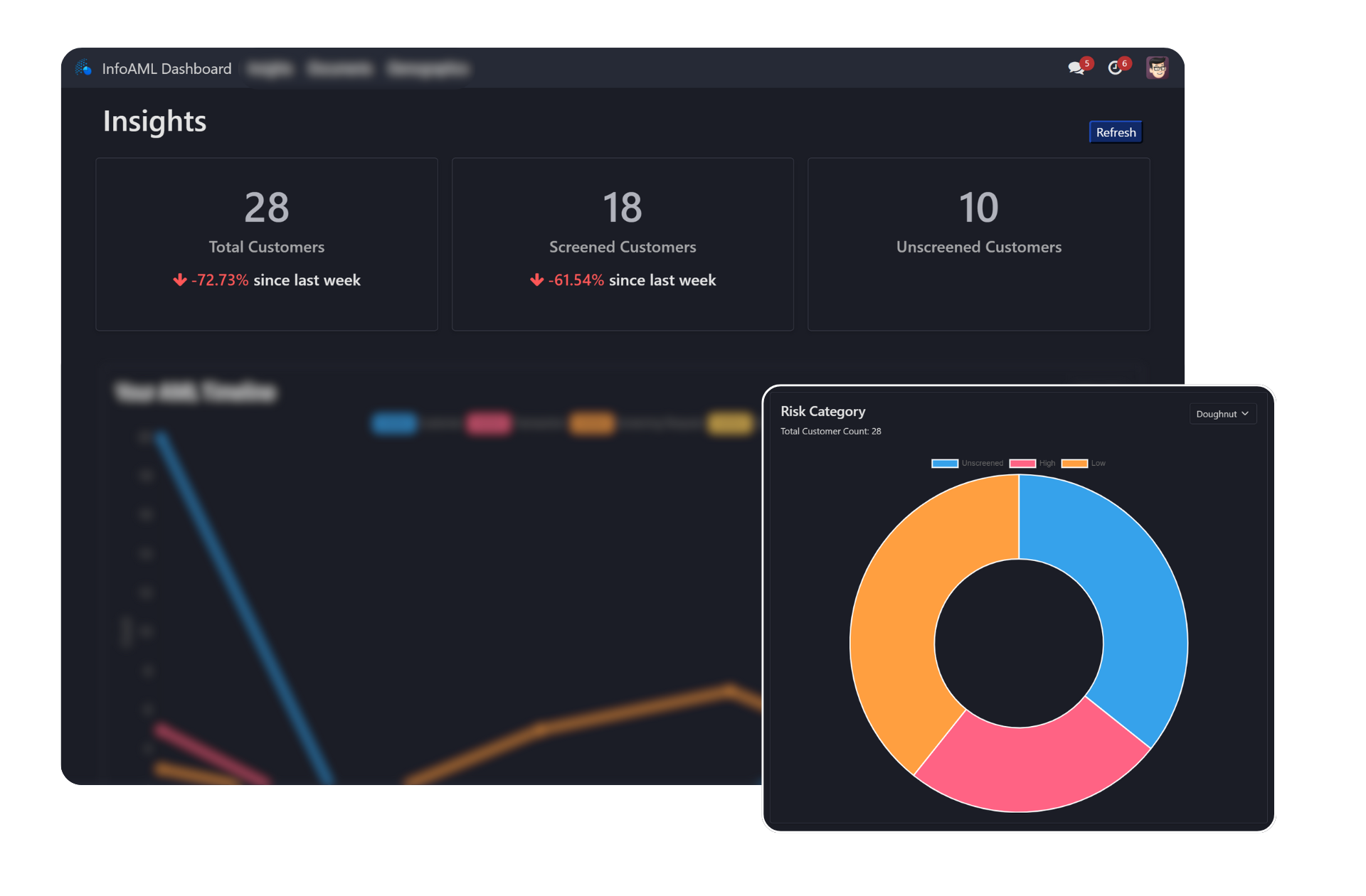

EXECUTIVE DASHBOARD

Real-Time Monitoring & Dashboards

Displays real-time statistics on screening activities, flagged alerts, and pending cases.

Refreshes sanctions data multiple times a day (at least four), ensuring your checks always use the latest information.

Provides a straightforward, step-by-step interface for AML checks, making it simple for compliance officers to navigate and follow.

Displays real-time statistics on screening activities, flagged alerts, and pending cases.

Refreshes sanctions data multiple times a day (at least four), ensuring your checks always use the latest information.

Provides a straightforward, step-by-step interface for AML checks, making it simple for compliance officers to navigate and follow.

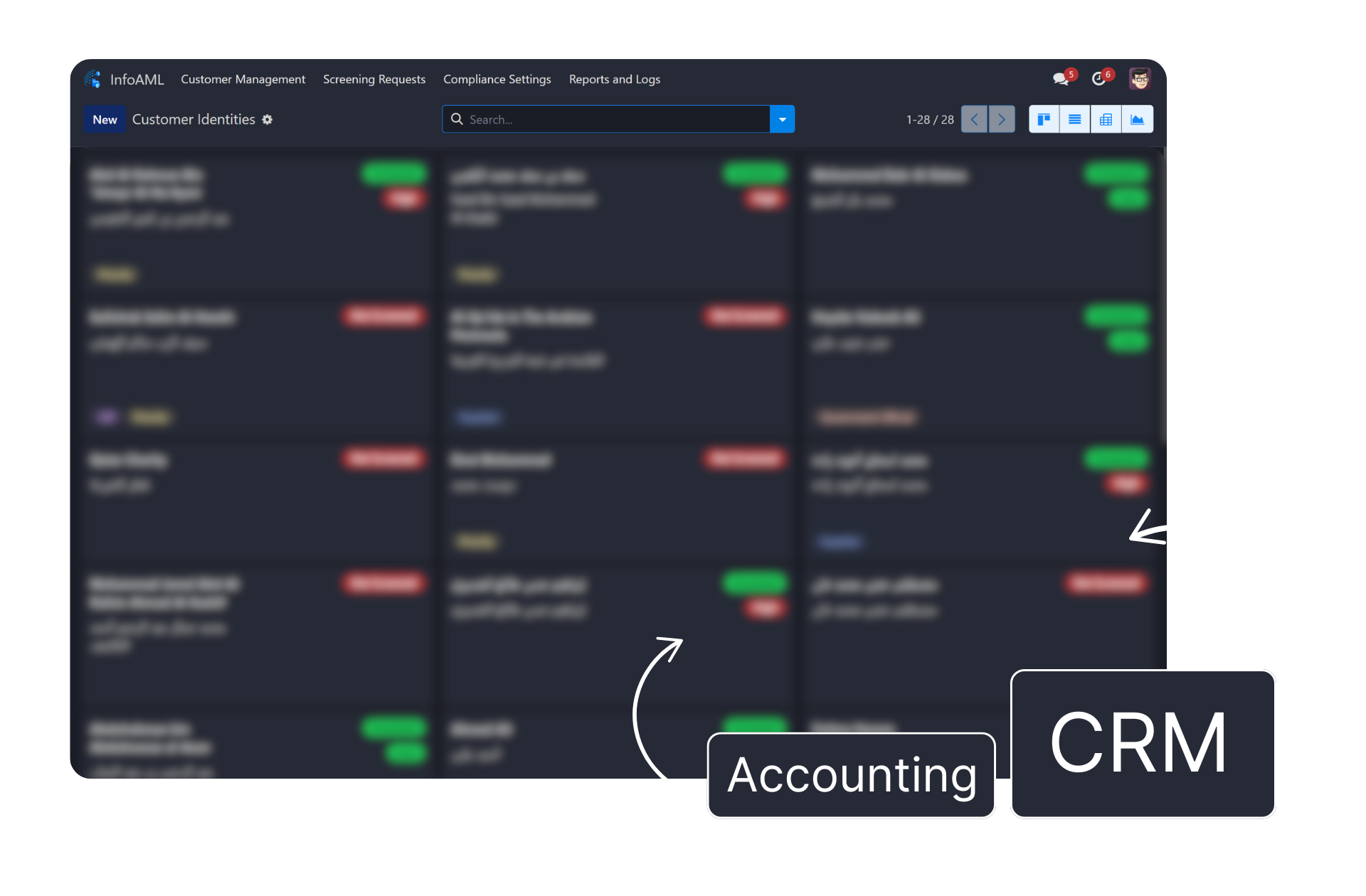

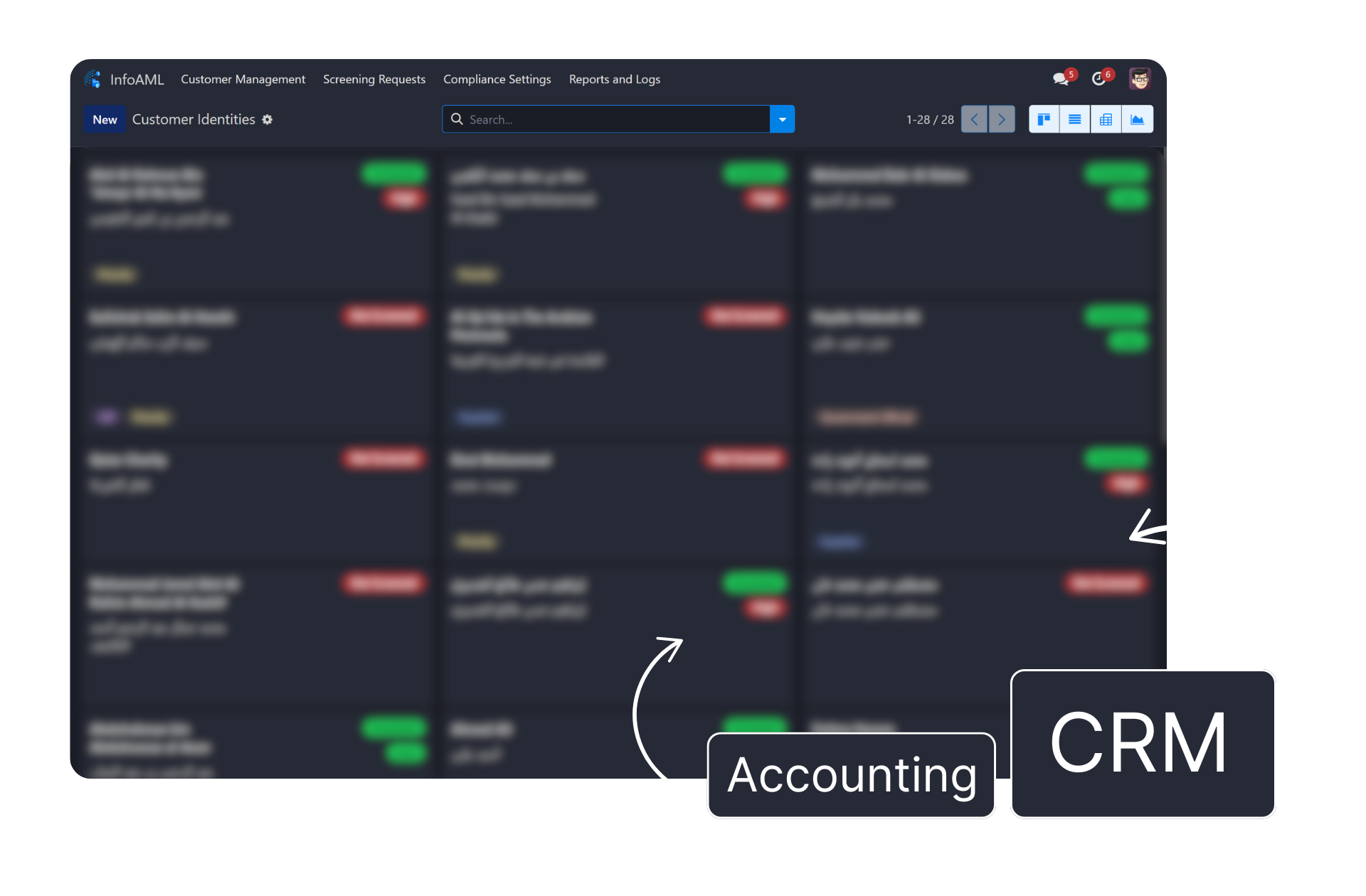

THIRD-PARTY INTEGRATION

Scalability & Easy Integration

Our system’s API is embedded within the AML module for seamless data exchange. With custom development, it can also be extended to integrate with other systems such as CRM or Accounting platforms if needed.

Our solution is built to handle increasing screening volumes as your customer base grows, ensuring consistent performance over time.

Offered as a cloud-based system with seamless updates, and customizable for on-premise deployment if required.

Our system’s API is embedded within the AML module for seamless data exchange. With custom development, it can also be extended to integrate with other systems such as CRM or Accounting platforms if needed.

Our solution is built to handle increasing screening volumes as your customer base grows, ensuring consistent performance over time.

Offered as a cloud-based system with seamless updates, and customizable for on-premise deployment if required.

AML SERVICES

Potential Add-On Services

Compliance policies, AML procedures, red flag manuals, and KYC forms are available and can be fully tailored to include your company’s branding, name, logo, and relevant details. (Clients are encouraged to develop their own red flag criteria as part of their internal procedures.)

On-site or virtual training sessions equip your team with AML best practices, complete with certification for key staff members.

Tailored advisory support is available to help organizations develop or refine their AML frameworks, risk assessments, and regulatory processes.

Compliance policies, AML procedures, red flag manuals, and KYC forms are available and can be fully tailored to include your company’s branding, name, logo, and relevant details. (Clients are encouraged to develop their own red flag criteria as part of their internal procedures.)

On-site or virtual training sessions equip your team with AML best practices, complete with certification for key staff members.

Tailored advisory support is available to help organizations develop or refine their AML frameworks, risk assessments, and regulatory processes.

FULL LIST OF FEATURES

AML Compliance Features

Below is a summary of InfoAML’s key features, designed to support UAE AML regulations with tools like goAML reporting, PEP screening, risk monitoring, and secure record keeping.

|

Feature & Description |

Available in InfoAML |

|---|---|

| Sanctions Screening Real-time checks against UAE, UN, and global sanctions lists to prevent high-risk engagements. |

|

| PEP Screening Identifies Politically Exposed Persons to help assess elevated compliance risk. |

|

| goAML Reporting Prepares STR/SAR reports in the correct format and allows submission via email to designated compliance recipients at the click of a button. |

|

| STR & SAR Report Preparation Automatically generates Suspicious Transaction and Activity Reports. |

|

| Risk-Based Monitoring Continuously monitors activity and adjusts risk levels dynamically. |

|

| Arabic & English Name Matching Supports multilingual name screening across scripts to reduce false positives. |

|

| Real-Time Alerts Instantly notifies users when suspicious behavior is detected. |

|

| Customer Risk Assessment Assigns dynamic risk scores based on KYC data, transactions, and screening results. |

|

| Case Management & Audit Trails Tracks investigations and logs actions to ensure full auditability. |

|

| Record Keeping Securely stores compliance decisions, alerts, and history in line with regulatory standards. |

|

| Document Management System Upload and manage client documents with tags, categories, and access control. |

|

| Contact Management Maintain customer and stakeholder profiles with linked KYC and communication records. |

|

| Bulk Screening Upload and screen several entities at once for speed and efficiency. |

|

| Automated Risk Scoring Uses intelligent rules to assign risk scores with minimal manual intervention. |

|

| Customizable Risk Rules Define internal risk rules based on your business’s risk appetite and policies. |

|

| Customer Insights Dashboard View all customer compliance data, screening history, and documents in one place. |

|

| Secure Data Handling All data is encrypted and access-controlled to meet UAE data security requirements. |

|

| Regulatory Updates Stay compliant with automatic system updates aligned with UAE AML/CFT changes. |

|

| System Integration APIs and connectors to integrate with your ERP, CRM, or accounting systems. |

|

| User-Friendly Interface Built for compliance teams, simple, intuitive, and accessible. |

|

| Training & Support Ongoing support and onboarding resources to help you get the most from InfoAML. |

Whether you’re a real estate company, DNFBP, or financial service provider, InfoAML equips your team with the tools to meet regulatory obligations and reduce risk with confidence. Every feature in this list is backed by our commitment to usability, data security, and compliance excellence.

FULL LIST OF FEATURES

AML Compliance Features

Below is a summary of InfoAML’s key features, designed to support UAE AML regulations with tools like goAML reporting, PEP screening, risk monitoring, and secure record keeping.

|

Feature & Description |

Available in InfoAML |

|---|---|

| Sanctions Screening Real-time checks against UAE, UN, and global sanctions lists to prevent high-risk engagements. |

|

| PEP Screening Identifies Politically Exposed Persons to help assess elevated compliance risk. |

|

| goAML Reporting Prepares STR/SAR reports in the correct format and allows submission via email to designated compliance recipients at the click of a button. |

|

| STR & SAR Report Preparation Automatically generates Suspicious Transaction and Activity Reports. |

|

| Risk-Based Monitoring Continuously monitors activity and adjusts risk levels dynamically. |

|

| Arabic & English Name Matching Supports multilingual name screening across scripts to reduce false positives. |

|

| Real-Time Alerts Instantly notifies users when suspicious behavior is detected. |

|

| Customer Risk Assessment Assigns dynamic risk scores based on KYC data, transactions, and screening results. |

|

| Case Management & Audit Trails Tracks investigations and logs actions to ensure full auditability. |

|

| Record Keeping Securely stores compliance decisions, alerts, and history in line with regulatory standards. |

|

| Document Management System Upload and manage client documents with tags, categories, and access control. |

|

| Contact Management Maintain customer and stakeholder profiles with linked KYC and communication records. |

|

| Bulk Screening Upload and screen several entities at once for speed and efficiency. |

|

| Automated Risk Scoring Uses intelligent rules to assign risk scores with minimal manual intervention. |

|

| Customizable Risk Rules Define internal risk rules based on your business’s risk appetite and policies. |

|

| Customer Insights Dashboard View all customer compliance data, screening history, and documents in one place. |

|

| Secure Data Handling All data is encrypted and access-controlled to meet UAE data security requirements. |

|

| Regulatory Updates Stay compliant with automatic system updates aligned with UAE AML/CFT changes. |

|

| System Integration APIs and connectors to integrate with your ERP, CRM, or accounting systems. |

|

| User-Friendly Interface Built for compliance teams, simple, intuitive, and accessible. |

|

| Training & Support Ongoing support and onboarding resources to help you get the most from InfoAML. |

Whether you’re a real estate company, DNFBP, or financial service provider, InfoAML equips your team with the tools to meet regulatory obligations and reduce risk with confidence. Every feature in this list is backed by our commitment to usability, data security, and compliance excellence.

Want to see how these features solve AML compliance challenges in the UAE?

👉 Explore our full AML Compliance Solution